Successful IT Integration Strategy for Mergers and Acquisitions

When companies engage in mergers and acquisitions (M&A), integrating their Information Technology (IT) systems plays a crucial role in determining the success of the transition.

Today, we will delve into IT integration in M&A, the impact of due diligence on IT integration, strategies for developing an IT integration plan, critical components of successful post-merger IT integration, and highlight the essential elements for successful post-merger IT integration. We will also outline the necessary steps to construct a strong IT integration strategy for acquisitions.

What is M&A IT Integration

M&A IT integration refers to combining the information technology systems and infrastructure of two or more companies that have merged or been acquired. It involves consolidating and aligning the technological resources, applications, and processes to create a unified and efficient IT environment.

M&A integration is critical to any merger or acquisition as it combines the operations, cultures, and systems of two organizations. IT integration focuses explicitly on harmonizing the merging entities' technology infrastructures, applications, and data to achieve seamless communication, collaboration, and operational efficiency.

What is the importance of IT integration in mergers and acquisitions?

Understanding the significance of IT integration in M&A is essential to recognize its role in achieving operational efficiency and maximizing the deal's value.

Mergers and acquisitions involve the consolidation of businesses, and effective IT integration ensures that the combined entity operates seamlessly as a unified organization.

Successful integration aligns IT systems, processes, and data, enabling the newly formed company to realize synergies and leverage economies of scale.

However, IT integration during mergers and acquisitions presents various challenges that organizations must address to ensure a smooth transition.

How can due diligence impact IT integration in M&A?

The role of due diligence in IT integration planning cannot be overstated. During the due diligence, organizations assess the target company's IT infrastructure, applications, and cybersecurity protocols to identify potential issues that may impact the integration.

This assessment helps evaluate IT systems' compatibility and uncover any risks or obstacles that could affect the successful integration of technology resources.

Identifying potential issues through due diligence allows acquirers to develop strategies for mitigating risks and addressing technology-related challenges before completing the M&A deal. By conducting comprehensive due diligence, organizations can make informed decisions about the integration process, ensure regulatory compliance, and protect the value of the acquisition.

Mitigating risks discovered during due diligence requires a proactive approach involving the integration team and relevant stakeholders to develop strategies that address technology gaps, cybersecurity vulnerabilities, and data privacy concerns. By addressing these issues early in the process, organizations can minimize disruptions and facilitate a smooth post-merger integration of IT systems.

Process for developing an IT integration Strategy for mergers and acquisitions

To successfully navigate the integration process in mergers and acquisitions (M&A), it is crucial to have a well-developed integration strategy. This strategy is a roadmap for combining the two merging entities' operations, systems, and technologies.

Here are some key areas to consider when developing an integration strategy:

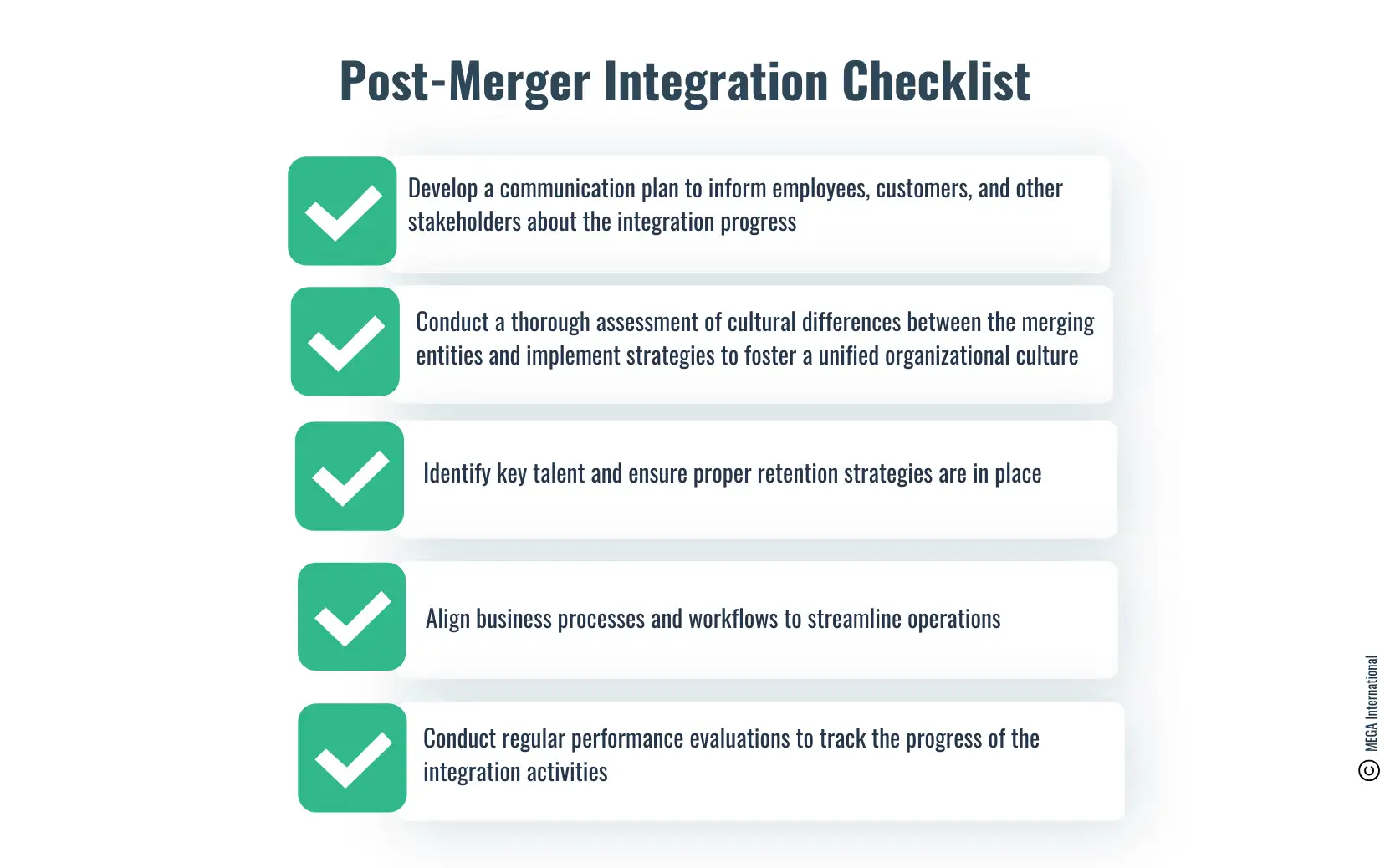

Post-Merger Integration Checklist

A post-merger integration checklist helps organizations stay organized and ensure all necessary steps during the integration process. Some essential items to include in the list are:

- Develop a communication plan to inform employees, customers, and other stakeholders about the integration progress

- Conduct a thorough assessment of cultural differences between the merging entities and implement strategies to foster a unified organizational culture

- Identify key talent and ensure proper retention strategies are in place

- Align business processes and workflows to streamline operations

- Conduct regular performance evaluations to track the progress of the integration activities

Implementing an Integration Plan

To implement a robust integration plan, it is essential to:

- Clearly define the objectives and goals of the integration process

- Assign dedicated teams responsible for different integration aspects, such as IT, HR, finance, and operations

- Regularly monitor and review the progress of integration activities against predefined milestones

- Communicate transparently with all stakeholders to address concerns and manage expectations

- Continuously evaluate and adjust the integration plan to ensure its effectiveness

Creating an IT Integration Plan

When merging two organizations, creating a comprehensive IT integration plan is essential. This plan outlines how the merging entities' IT systems, infrastructure, and applications will be consolidated and integrated. It includes:

- Assessing the IT landscape of both organizations, including hardware, software, networks, and database

- Identifying redundancies and inefficiencies in the IT systems to optimize the integration process

- Developing a timeline and milestones for the integration activities

- Establishing clear communication channels with stakeholders to ensure smooth coordination and minimize disruptions

Strategic Technology merger integration

Strategic technology integration involves aligning the IT capabilities of the merging companies to achieve synergies and maximize operational efficiency.

This can include:

- Evaluating the technology stack of both organizations and identifying opportunities for consolidation or enhancement

- Assessing the compatibility of systems, databases, and applications to ensure seamless integration

- Prioritizing critical technology initiatives that will support the overall business objectives of the merged entity

- Developing a governance structure to manage technology integration projects and ensure accountability

Role of Cybersecurity in M&A IT Integration

Cybersecurity is a critical aspect of M&A IT integration. It ensures the merged entity's IT infrastructure is secure and protected from threats.

Some considerations include:

- Conducting a comprehensive cybersecurity assessment of both organizations to identify vulnerabilities and risks

- Developing a cybersecurity strategy that addresses any gaps in security measures

- Implementing robust security controls and protocols to safeguard sensitive data during integration

- Training employees on cybersecurity best practices to mitigate the risk of data breaches or cyberattacks

- Establishing incident response plans to handle any security incidents effectively

What are the critical components of a successful post-merger IT integration?

Creating a practical IT integration playbook is critical to successful post-merger IT integration. The playbook outlines the methodologies, best practices, and guidelines for integrating IT systems, managing data migration, and addressing cybersecurity considerations. It provides a structured approach to the integration process, ensuring all stakeholders understand their roles and responsibilities in the transition.

Implementing a technology integration process involves coordinating the efforts of cross-functional teams, leveraging integration tools and platforms, and aligning IT processes to support post-merger operations. This process requires clear communication, change management strategies, and a diligent focus on minimizing disruptions while optimizing technology resources.

Ensuring cybersecurity in the post-merger IT integration is paramount to protecting the combined entity from potential threats and vulnerabilities. Organizations must implement robust security measures, conduct comprehensive risk assessments, and establish incident response protocols to safeguard the integrated IT infrastructure and information assets.

How can companies build a strong IT integration strategy for acquisitions?

Successful acquisition integration involves understanding the acquired company's technology landscape, identifying synergies, and establishing a roadmap for integrating IT systems while preserving the acquisition's value. Developing a synergy between the acquirer and the acquired company's IT systems requires collaboration, effective communication, and a holistic approach to integrating technology and processes.

Using IT integration to drive the newly acquired company's initiative involves aligning IT resources with the acquisition's strategic objectives, leveraging synergies to enhance operational efficiency, and facilitating a seamless transition for the acquired entity.

By effectively integrating technology resources, acquirers can unlock the potential of the acquired company and accelerate its growth within the integrated organization.

Overcoming Challenges in M&A IT Integration

Mergers and acquisitions (M&A) can present numerous challenges when integrating IT systems. The successful integration of technology plays a crucial role in ensuring the overall success of the merger or acquisition.

Managing Technology Integration Challenges

One of the primary challenges in M&A IT integration is the compatibility of the merged systems. Organizations often have different IT infrastructures, software applications, and data management practices, which can create obstacles when attempting to integrate technology seamlessly.

Another significant challenge is data migration. Consolidating data from multiple systems into one unified database can be complex and time-consuming. It requires careful planning and execution to ensure data integrity and avoid disruptions to business operations.

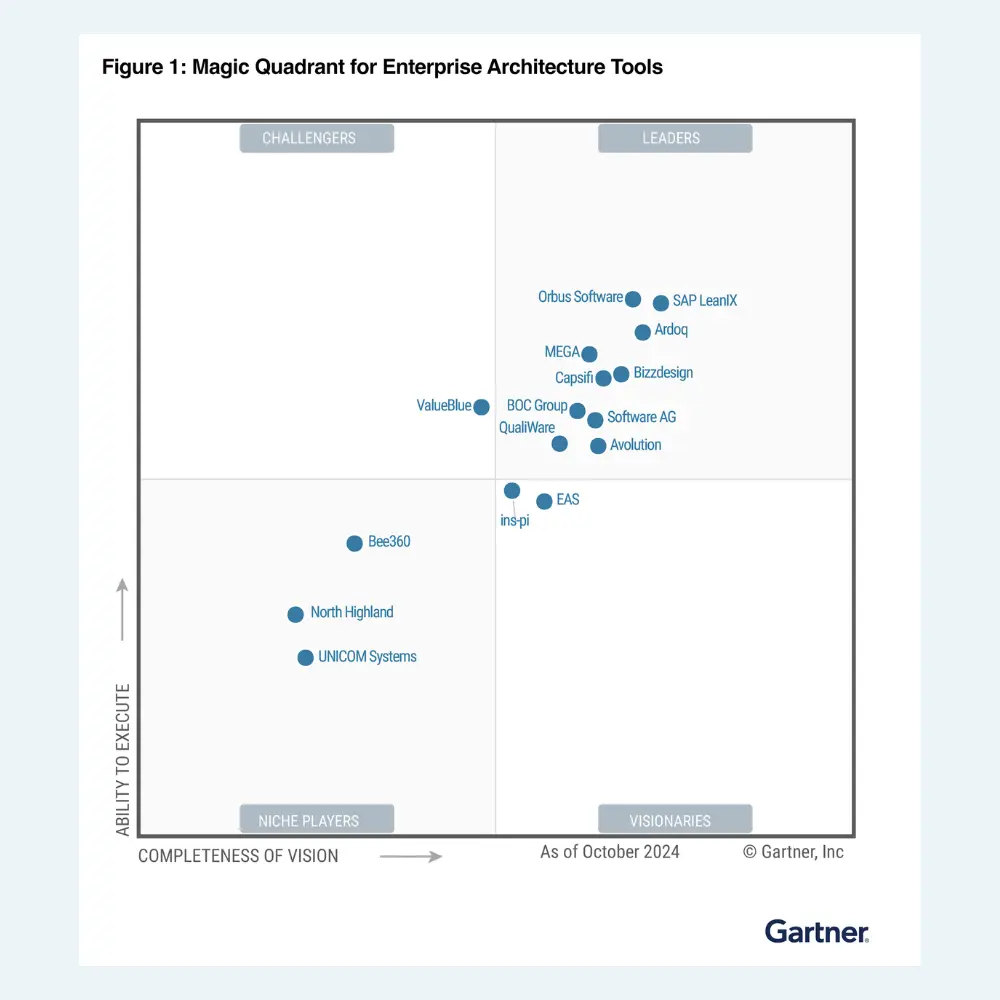

Get a complimentary copy: 2024 Gartner® Magic Quadrant™ for Enterprise Architecture Tools

The bad & the uglyOne example of an M&A gone awry was the case of Banco Sabadell’s acquisition of TSB from Lloyds in 2015. In April 2018, in a project to migrate 1.3 billion data records as part of the acquisition process, TSB customers reported glitches in the online system, and customers unable to access their online banking or, in some extreme cases, being able to view the accounts of other TSB users. The episode would ultimately cost TSB’s chief executive his job while losing 12,500 customers, an estimated £176 million in additional migration costs, and further losses on waived banking fees. In addition to the tangible losses for the bank, the failed migration has also led to a range of regulatory investigations and public scrutiny. While this is an extreme example, it provides food for thought in evaluating the role of IT in M&As. In this case, it certainly appears from the outside looking in that the integration of the organizations’ operations and technologies proved difficult, and, as in other examples, it perhaps demonstrates that IT did not receive sufficient emphasis during the due diligence phase. For McKinsey, one reason could be that “executives from IT and operations often aren’t included in the due diligence process, preventing them from offering valuable input on the costs and practical realities of integration." Specifically, it seems unlikely that a successful merge of supply chains and their associated operational processes would be fully effective without input from the very earliest stages of a process without a detailed understanding of the two organizations' IT systems. According to McKinsey, this key aspect in an M&A process is often overlooked despite the finding that 50-60% of initiatives to capture synergies as part of an M&A cycle are ‘strongly related’ to IT, but yet “most IT issues are not fully addressed during due diligence or the early stages of post-merger planning. |

Critical Factors for Successful Integration

To overcome these challenges, several critical factors must be considered during the IT integration process. Firstly, effective communication and collaboration between the IT teams of both organizations are essential. This includes sharing information about system architecture, applications, data structures, and security protocols.

Integration Process in M&A

Typically involves several stages:

- Thorough analysis of existing IT systems and infrastructure: This stage involves analyzing both organizations' IT systems and infrastructure to identify areas of compatibility and misalignment.

- Development of a detailed integration plan: The IT teams must develop a comprehensive integration plan that includes data mapping, system consolidation, and application rationalization. This plan should address potential challenges and outline specific integration steps.

- Implementation of the integration plan: It is put into motion once finalized. During this stage, it is crucial to closely monitor progress and promptly address any issues that may arise.

- Communication and stakeholder management: Regular communication with stakeholders and users is vital throughout the integration process. This helps ensure transparency, manage expectations, and inform everyone about progress and changes.

Driving Value through Successful M&A IT Integration

A successful merger or acquisition (M&A) involves combining business operations and integrating the two companies' IT systems and technology platforms.

This integration plays a crucial role in maximizing the value derived from the deal. Organizations can achieve operational efficiencies, cost savings, and improved business performance by aligning and consolidating IT infrastructure, applications, and processes.

To maximize deal value through integration, companies must develop a comprehensive integration strategy that addresses critical areas such as IT governance, infrastructure consolidation, application rationalization, data integration, and talent management. A clear roadmap and timeline are essential for integrating the IT capabilities of both organizations while minimizing disruption to ongoing operations.

Full Potential of M&A Technology Integration

Successful M&A technology integration goes beyond simply combining IT systems; it aims to realize the full potential of the acquired technology assets. This involves leveraging both organizations' best practices, expertise, and innovative solutions to create a more efficient and agile IT environment.

That the integration of the organizations’ operations and technologies proved difficult, and, as in other examples, it perhaps demonstrates that IT did not receive sufficient emphasis during the due diligence phase

To achieve this, companies should focus on:

- Standardization and Consolidation: Streamlining IT infrastructure and applications by adopting common platforms and eliminating duplications. This enables cost savings, improved scalability, and easier management.

- Process Optimization: Identifying opportunities to streamline and optimize business processes using integrated technology solutions. This can increase productivity, reduce cycle times, and enhance customer experience.

- Data Integration and Analytics: Integrating data from different systems to gain a unified business view. Leveraging advanced analytics tools can uncover valuable insights and drive data-driven decision-making.

- Talent Development: Ensure the combined organization has the right skills and expertise to effectively manage the integrated IT environment. Investing in training and development programs can help employees adapt to new technologies and ways of working.

Measuring the Success of the M&A IT Integration

Measuring the success of M&A IT integration is crucial to assessing the integration efforts' effectiveness and identifying areas for improvement. Key performance indicators (KPIs) can be used to evaluate the integration process's outcomes and impact.

Some common KPIs include:

- Operational Efficiency: Assessing the efficiency gains achieved through IT integration, such as reduced IT costs, improved system availability, and faster response times.

- Business Performance: Evaluating the impact of IT integration on crucial business metrics, such as revenue growth, customer satisfaction, and market share.

- User Satisfaction: Gathering feedback from employees and end-users to understand their satisfaction with the integrated IT systems and support services.

- IT Governance and Risk Management: Assessing the effectiveness of IT governance processes, compliance with regulatory requirements, and risk mitigation strategies post-integration.

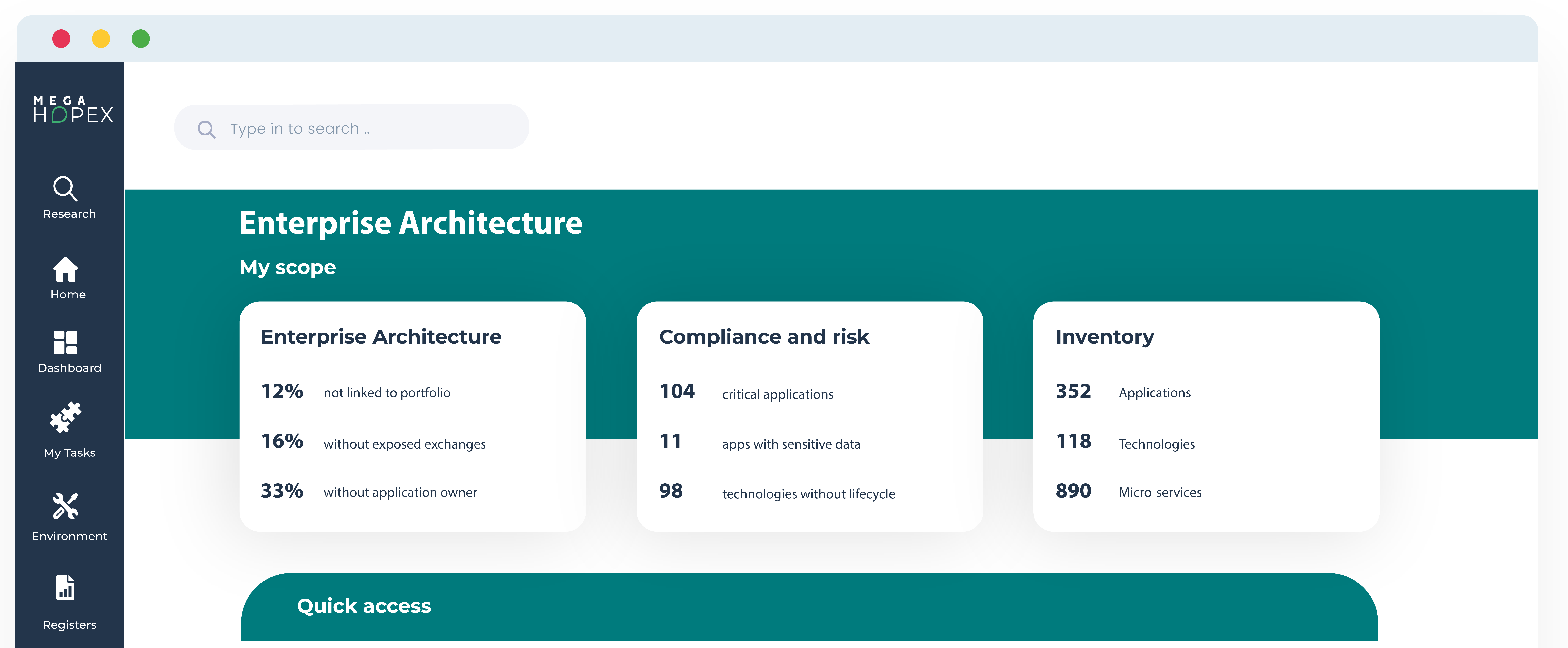

How Hopex can help with IT Integration Strategy for Mergers and Acquisitions

The Hopex platform assists organizations in developing and implementing an effective IT integration strategy for mergers and acquisitions.

Here are some ways in which Hopex can help:

- Visualization and Analysis: Hopex provides powerful visualization and analysis capabilities to understand the existing IT landscape of both merging organizations. It can help identify redundancies, gaps, and opportunities for consolidation.

- Process Harmonization: Hopex allows organizations to map and analyze their business processes, enabling them to identify areas for harmonization and standardization. This helps streamline operations and improve efficiency during the integration process.

- Data Integration: Hopex enables data integration from different systems, making consolidating and sharing information across departments easier. This promotes better collaboration and decision-making.

- Application Portfolio Management: Hopex helps organizations assess their application portfolios, identifying redundant or overlapping applications. It assists in rationalizing the application landscape by determining which applications to retain, retire, or replace during the integration process.

- Data Modeling: HOPEX offers robust features for modeling data, enabling a comprehensive understanding of how processes and systems utilize this information. Mapping the data managed by each system is necessary before consolidating them into one unified database.

- Change Management: Hopex supports change management activities by providing a centralized platform for documenting and tracking IT integration initiatives. It helps manage risks, dependencies, and timelines associated with the integration strategy.

- Governance and Compliance: Hopex offers capabilities for establishing governance frameworks and ensuring compliance with regulatory requirements. This is particularly important during mergers and acquisitions when organizations need to align their IT processes and controls.

Hopex provides a holistic approach to IT integration strategy for mergers and acquisitions, helping organizations streamline operations, enhance collaboration, and achieve successful integration outcomes.

FAQs

M&A IT Integration Strategy refers to the plan and approach for combining two organizations' technology systems, processes, and personnel following a merger and acquisition (M&A) deal. It involves aligning the technology integration with the overarching business objectives and leveraging synergy to realize the full potential of the combined entities.

A well-defined integration plan is crucial for the success of an M&A deal as it facilitates a seamless transition and minimizes operational disruptions. It ensures that the acquirer and the acquired company can effectively combine their resources and capabilities, maximizing the deal value and creating a foundation for future growth.

The critical components of an M&A IT Integration Strategy include technology integration, data migration, cybersecurity measures, and due diligence in assessing the technology. Infrastructure and the integration process itself. Additionally, a successful strategy involves building an integration team that oversees the entire integration process, ensuring a smooth transition.

Organizations can ensure successful IT integration in M&A by developing a flourishing IT integration strategy aligned with the overall business goals. This strategy should prioritize cybersecurity, streamline technology merger integration, and involve a thorough integration in M&A to harmonize the technology systems of the merging entities.

Post-merger, the integration strategy for mergers and successful M&A technology integration is instrumental in realizing the deal's benefits and achieving the envisioned synergies. A robust IT integration plan serves as the foundation for the success of the M&A and sets the stage for a smooth M&A transition.

Bridge the Gap Between Strategy and Execution

Build a Strong Business Architecture and IT Architecture Alignment.

One must consider five principles to achieve business and IT architecture alignment. This white paper will further explore these topics and provide key steps for aligning business and IT architecture.

Enterprise Architecture Related Content

Shift from a documentation tool to an operational tool and accelerate business transformation

MEGA HOPEX for Enterprise Architecture

Request a demonstration of HOPEX for EA, and see how you can have immediate value of your projects.