Governance, Risk and Compliance Trends, 2024

As we step into 2024, the landscape of governance risk and compliance (GRC) is evolving more rapidly than ever. Organizations face many challenges and opportunities as they navigate this complex field.

Let's explore the critical subject of governance risk and compliance trends for 2024.

Key Compliance Trends for 2024

Compliance, a crucial component of GRC, is set to witness significant transformations in 2024. The impact of regulatory changes, the integration of artificial intelligence in compliance processes, the emphasis on cyber resilience, and the management of Environmental, Social, and Governance (ESG) compliance are poised to be the key drivers of change.

Here are some of the key trends that are expected to shape GRC in 2024:

Digital Transformation and Emerging Technologies

Digital transformation continues to revolutionize industries across the globe, bringing both opportunities and risks. In 2024, we can expect governance, risk, and compliance functions to embrace emerging technologies such as artificial intelligence (AI), machine learning (ML), blockchain, the Internet of Things (IoT), and robotic process automation (RPA). These technologies have the potential to enhance efficiency, improve decision-making processes, reduce human errors, streamline regulatory compliance efforts, and strengthen security measures.

Cybersecurity and cyber resilience

Cyber regulations are evolving rapidly as the cyber menace becomes more prevalent in today's interconnected world. In 2024, GRC practices will focus on complying with new cyber resilience regulatory requirements such as the Digital Operational Resilience Act (DORA) in Europe or the Sounds Practice for Cyber Resilience from the Office of the Comptroller of the Currency (OCC) in the United States.

| Organizations will invest heavily in cybersecurity solutions to strengthen security. Cyber regulations are evolving rapidly as the cyber menace becomes more prevalent in today's interconnected worldmeasures like encryption techniques, identity management systems, penetration testing tools, and employee training programs to safeguard their valuable data assets. |

Ethical Business Practices

Society's expectations regarding corporate social responsibility continue to evolve. In response to increasing emphasis on ethics and sustainability concerns from customers and stakeholders alike, GRC professionals must ensure organizations operate ethically while adhering to relevant regulations such as the recent CSRD (Corporate Sustainability Reporting Directive) in Europe.

In addition, to combat corruption, fraud, and bribery, GRC teams may implement robust anti-fraud programs, optimize whistleblowing mechanisms, and foster a culture of integrity throughout an organization.

Continuous Monitoring and Auditing

Continuous monitoring techniques are replacing traditional periodic audits. Real-time monitoring tools provide organizations instant insights into potential risks or non-compliance issues.

Implementing advanced analytics combined with AI-powered audit bots enables quick identification of anomalies, reduces manual efforts, and saves time, costs, and labor resources. Irregularities can then be promptly addressed before they escalate significantly.

Agile Risk Management

An agile approach allows businesses to quickly adapt to changing market conditions, new regulations, or emerging risks. By adopting agile methodologies, GRC teams can enhance risk assessment processes by facilitating collaboration across departments, enabling faster decision-making, introducing flexible risk management frameworks, and responding proactively to emerging risks.

Impact of Regulatory Changes

Regulatory changes have always been a cornerstone of compliance dynamics. In 2024, Organizations will likely face more rigorous regulatory requirements across different sectors and geographies.

This means compliance functions must be more robust and agile to keep up with the changing regulations.

Integration of AI in Compliance

AI is expected to play a significant role in GRC, with organizations adopting AI-driven tools for risk assessments, compliance monitoring, and decision-making processes. These tools can help identify patterns, predict risks, and automate repetitive tasks to enhance efficiency.

ESG (Environmental, Social, Governance)

The focus on environmental, social, and governance factors continues to gain momentum. Incorporating sustainable business practices has become paramount for organizations seeking long-term success.

In 2024, GRC functions will align with Environmental, Social, and Governance (ESG) frameworks such as the Global Reporting Initiative(GRI)or Sustainability Accounting Standards Board(SASB). Organizations must disclose their ESG strategies, strive for carbon neutrality, promote diversity and inclusion, and demonstrate effective board oversight.

Cybersecurity Challenges and Opportunities

In the wake of rising cyber threats, cybersecurity will remain a top priority within GRC strategies. Businesses must integrate cybersecurity practices deeply into their risk management frameworks to protect sensitive data and maintain customer trust.

The regulatory landscape in 2024 will aim to address cybersecurity challenges while presenting opportunities for organizations to bolster their cyber resilience through compliance mechanisms.

What are the Emerging GRC Trends for 2024?

Risk management lies at the heart of GRC, and 2024 is expected to witness pivotal changes in this domain. Adopting agile compliance frameworks, interconnected GRC processes, and evolved risk mitigation strategies are among the emerging GRC trends.

Integrated GRC Platforms

There will be a push towards integrated GRC platforms that offer a unified view of risks and compliance requirements across the organization. This consolidation allows for better risk visibility, streamlined reporting, and improved decision-making.

Adoption of Agile Compliance Frameworks

Agility in compliance frameworks will be imperative in 2024. Organizations must adopt flexible, scalable compliance models that adjust to regulatory changes and drive business continuity amidst evolving compliance requirements.

Interconnectivity of GRC Processes

The interconnectivity of GRC processes is set to gain prominence, reflecting the need for unified risk and compliance management. This trend will drive organizations to streamline GRC processes, fortify business continuity, and cohesively manage risks.

How Can Organizations Navigate the Evolving Regulatory Landscape in 2024 and Beyond?

Organizations grappling with the evolving regulatory landscape in 2024 must leverage technological advancements, adopt robust risk mitigation strategies, and harness interconnected GRC platforms to effectively navigate the changes.

Using AI and Automation for GRC Processes

The utilization of AI and automation will play a pivotal role in simplifying GRC processes, automating compliance monitoring, and facilitating predictive analysis for risk management. This integration of AI will enable organizations to streamline GRC operations and fortify their compliance mechanisms.

Risk Mitigation Strategies for Emerging Risks

Risk mitigation strategies must evolve to address emerging risks such as cybersecurity threats, regulatory changes, and operational vulnerabilities. Organizations must proactively manage these risks through agile risk management frameworks and proactive risk assessment approaches.

What Role Will AI Play in Governance, Risk, and Compliance in 2024?

Artificial Intelligence (AI) is set to be a transformative force in governance, risk, and compliance (GRC) practices in 2024. Its impact will extend to risk assessment, compliance monitoring, and predictive analytics for risk management.

Integration of AI in Risk Assessment

AI technologies will revolutionize risk assessment, enabling organizations to conduct real-time risk evaluations, identify vulnerabilities, and fortify risk management strategies. This integration will encourage organizations to manage risks and compliance requirements proactively.

Automation of Compliance Monitoring

Automating compliance monitoring through AI will streamline the oversight of regulatory adherence, detect anomalies, and facilitate proactive compliance management. This automated approach will bolster organizations' capabilities to ensure compliance with evolving regulations.

Modeling and Predictive Analysis for Risk Management

AI-driven modeling and predictive analysis will empower organizations to anticipate risks, model potential scenarios, and fortify risk management frameworks. This predictive approach will enable organizations to mitigate risks proactively and optimize their GRC strategies.

How will technology influence GRC strategies in 2024?

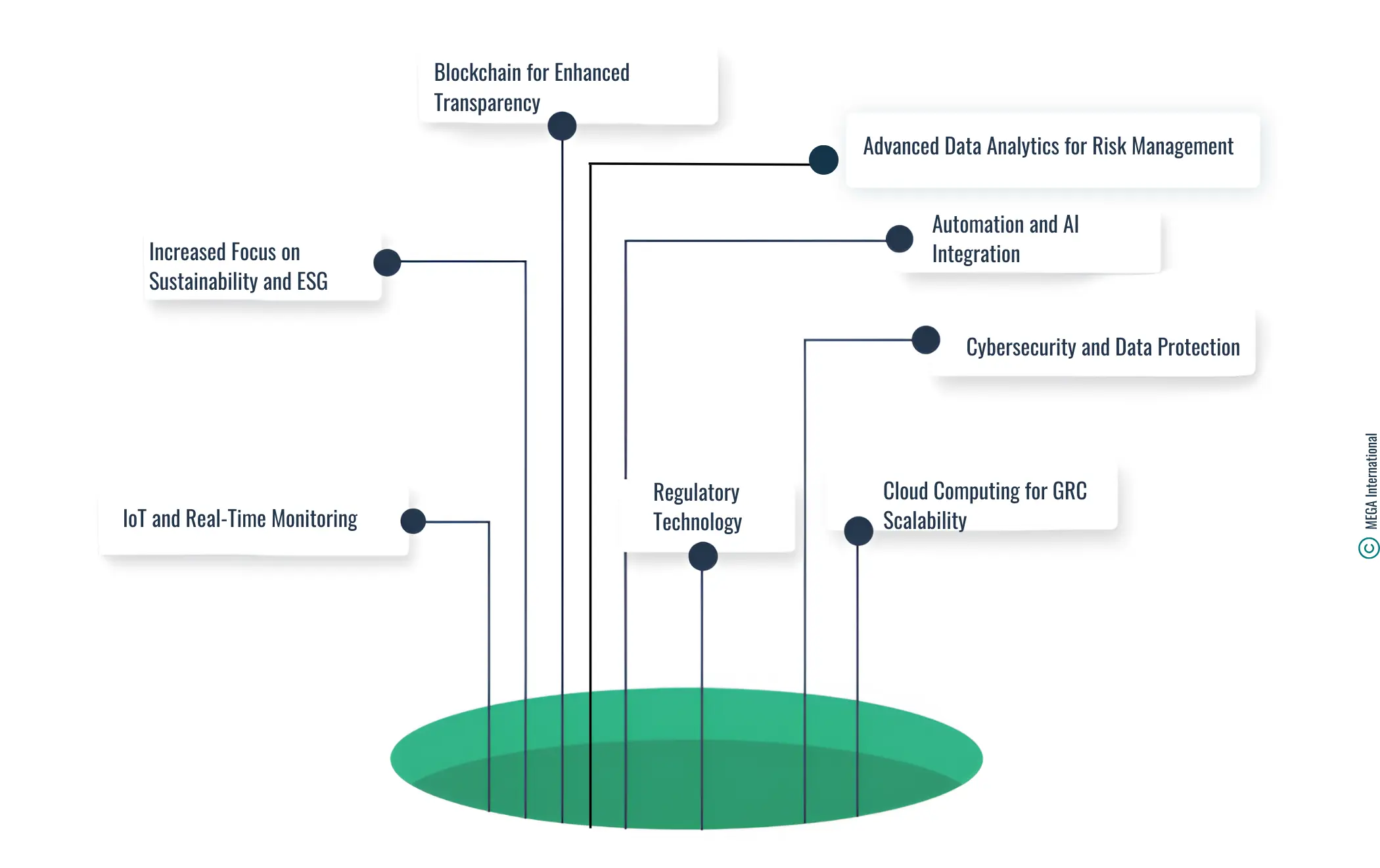

Technology is significantly influencing Governance, Risk, and Compliance (GRC) strategies in 2024 in several ways:

- Automation and AI Integration: GRC increasingly relies on automation and artificial intelligence. AI algorithms can predict potential compliance risks, automate routine compliance and risk management tasks, and streamline workflow processes. This enhances efficiency, reduces the likelihood of human error, and frees up human resources for more complex tasks.

- Advanced Data Analytics for Risk Management: Advanced data analytics tools have become crucial for risk assessment and management. These tools can analyze large datasets to identify trends, patterns, and potential risks, helping organizations be more proactive and data-driven in risk management strategies.

- Blockchain for Enhanced Transparency: Blockchain technology is increasingly adopted in GRC for its transparency and immutability. It provides clear, tamper-proof records essential for auditing and regulatory compliance, particularly in finance, supply chain management, and corporate governance.

- Cybersecurity and Data Protection: As digital threats become more sophisticated, cybersecurity and data protection are central to GRC strategies. Organizations are implementing advanced encryption methods, continuous monitoring systems, and regular security audits to protect against data breaches and ensure compliance with evolving data protection regulations.

- Regulatory Technology (RegTech): The rise of RegTech solutions offers specialized tools to manage regulatory processes, ensuring businesses are updated with the latest regulatory changes and remain compliant. This includes compliance management systems, reporting tools, and solutions for monitoring regulatory developments.

- Cloud Computing for GRC Scalability: The adoption of cloud computing in GRC provides scalability and flexibility. Cloud-based GRC solutions can adapt to changing business needs and regulatory environments, allowing more efficient data storage, processing, and collaboration across different locations and departments.

- IoT and Real-Time Monitoring: Integrating the Internet of Things (IoT) in GRC allows for monitoring real-time compliance and risk factors. IoT devices can provide immediate data on various risk indicators, from environmental conditions in manufacturing to real-time financial transactions, aiding in more immediate and informed decision-making.

- Increased Focus on Sustainability and ESG: Technology enables a stronger focus on Environmental, Social, and Governance (ESG) factors in GRC. Digital tools monitor and report on sustainability practices, social responsibility initiatives, and corporate governance, aligning them with regulatory requirements and societal expectations.

Read: Business Resilience Explained

| These technological advancements are reshaping GRC strategies in 2024, making them more dynamic, data-driven, and efficient while adapting to the rapidly changing regulatory landscape and emerging risks. |

Summary

In conclusion, 2024 will witness several critical governance, risk, and compliance trends. Organizations must embrace digital transformation and leverage emerging technologies to optimize their operations.

Cybersecurity and data privacy will remain top priorities, while ethical business practices guided by societal expectations will be paramount. The ever-evolving regulatory landscape presents challenges, necessitating integrated GRC solutions for effective compliance. Consequently, sustainability factors, including ESG considerations, will gain prominence. Continuous monitoring and agile risk management strategies will empower organizations to adapt and thrive amidst uncertainty.

FAQs

The critical compliance trends for 2024 are centered around embracing automation and AI technologies to streamline governance, risk management, and compliance processes. Additionally, there is a growing focus on ESG (Environmental, Social, and Governance) considerations and cybersecurity measures to fortify organizational compliance.

GRC is evolving in 2024 to adapt to the regulatory changes and the encompassing regulatory landscape. It also increasingly leverages AI for compliance and risk assessment to unify risk and compliance efforts across organizational functions.

In 2024, the emerging risks in the GRC sphere revolve around third-party relationships, cybersecurity vulnerability, and navigating the evolving regulatory landscape. Organizations also focus on business continuity and agility to address these emerging risks.

In 2024, AI and automation are poised to revolutionize GRC by enabling streamlined and agile compliance processes. These technologies will facilitate the unification of risk and compliance efforts, with AI applications augmenting audit and oversight functions.

Governance, Risk and Compliance Related Content

Enhance operational resilience using integrated risk management

MEGA HOPEX for GRC

Request a demonstration of HOPEX for GRC, and see how you can have immediate value of your projects.